Happy Friday!

The Startup Sitdown is an end-of-the-week series where I cover a directional arrow of progress & a few interesting startups in line with that arrow.

Today’s arrow of progress: consumer choice and personalization.

Let’s dive right in ⬇️

A directional arrow of progress is this idea of evolving consumer choice and personalization.

More specifically, founders are leveraging big data and AI to deliver tailored financial and health experiences for users.

There are two major industries this is happening right now: femtech and fintech.

Femtech ♀️

London-based AI-powered health app providing accurate cycle predictions and personalized daily health insights.

Madrid-based app using machine learning techniques to provide personalized parameters on women’s reproductive health.

Fintech 💸

An online investment company that offers investing + retirement solutions for current clients and clients-to-be.

4-year-old NY-based AI-powered personalized wealth and asset management platform.

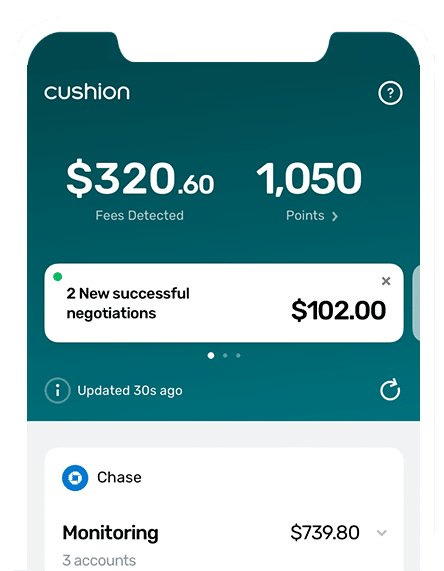

AI tool that negotiates fees and interest charges on the user’s behalf.

Top 2 Takeaways

More & more fintech companies are leveraging a buy-now-pay-later model (without interest 🎉) to create an even more personal and delightful financial experience for users 🤑

Hyper-personalization has resulted in another directional arrow of progress: the rise of ethical artificial intelligence 🧠

Hyper-personalization and concerns around consumer data privacy are definitely raising some eyebrows, especially with highly secretive filtering algorithms on platforms like TikTok, Facebook and Amazon.

Although the rise of user choice + personalization is creating seamless user experiences, it also fundamentally alters the way we encounter ideas & information on a daily basis 📊

Therefore, ethical AI is a critical subfield to consider when creating hyper-personalized consumer tech.